Financing Options through Hearth

Renovation Financing

An important step in any home improvement project is deciding how to pay for it. There are multiple ways to finance a home renovation, including options that use home value equity and non-equity options like personal loans and credit cards. Unsecured personal loans can help homeowners finance a project quickly. Hearth can fund a loan within a week, in contrast to home equity financing, which involves time-consuming underwriting and appraisal processes. Personal loans are good options for urgent repairs or projects you want to start quickly.

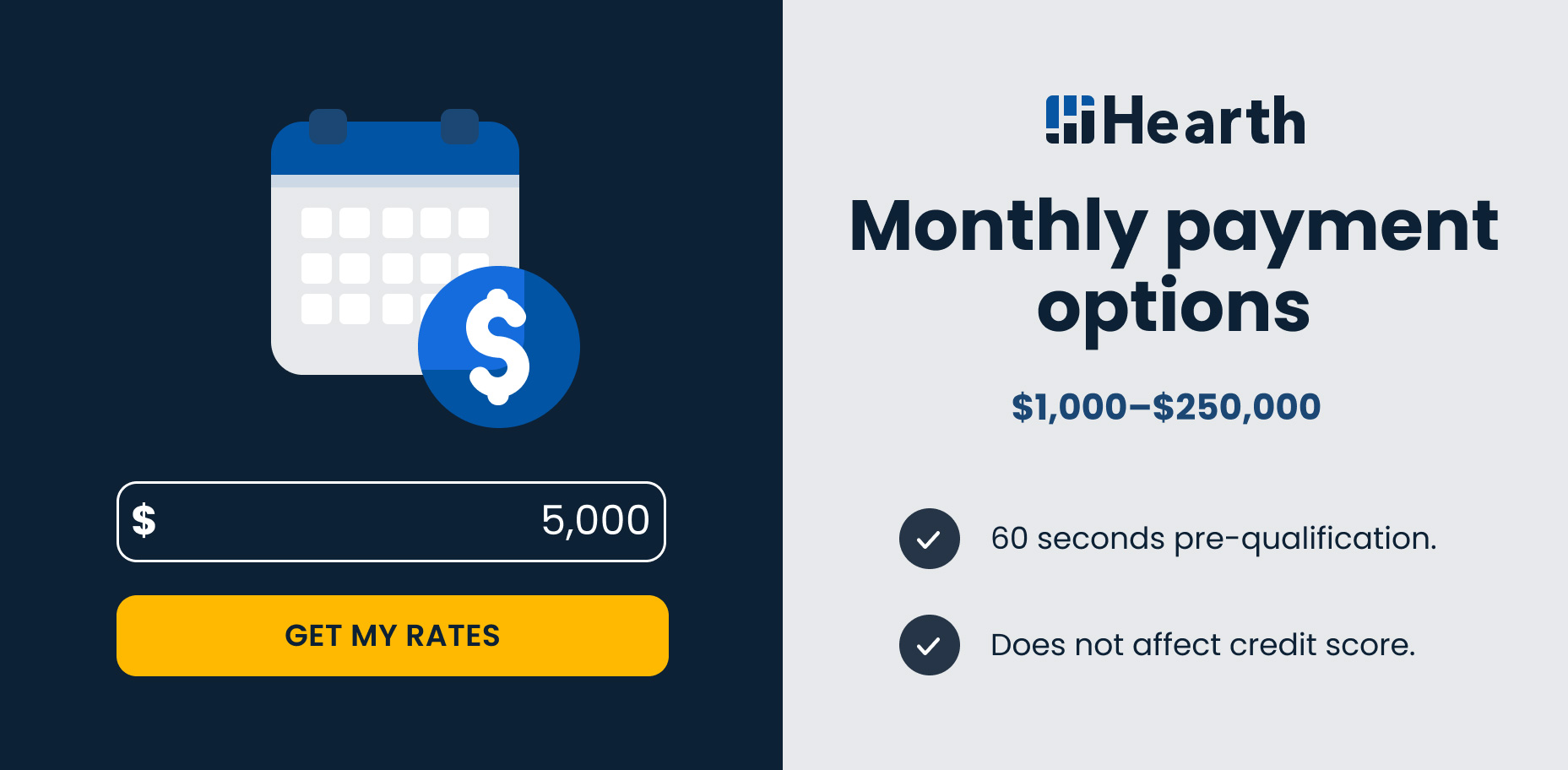

Seacoast Building & Design provides Hearth as a loan option for your home renovations. See your personalized monthly payment options within minutes and without affecting your credit score. Hearth makes it easy for you to consider monthly payments:

- Loan amounts up to $250,000

- Affordable monthly payment options

- Funding within 1-3 days

- No prepayment penalties

- No home equity is required

Step 1.

Apply For A Loan

Step 2.

Speak To Agent

Step 3.

Provide Documents

Step 4.

Fund Your Loan

Fast Loans for Your Home Improvement Project

We’ve teamed up with Hearth, the leader in home improvement financing, to find you competitive loan options that save you money and get your project done right. Hearth is a technology company, which is licensed as a broker as may be required by state law. Hearth does not accept applications for credit, does not make loans, and does not make credit decisions. Hearth works with various lending partners to show customers available financing options; all loans are subject to credit approval. Lending partners also determine rates based on your specific financial profile. Here are the main four factors they consider:

1. Creditworthiness

Unsecured personal loans, like those found through Hearth, have higher rates than loans secured by home equity. Because Hearth’s lending partners can’t foreclose your home, they need another type of assurance to ensure that you will pay back the loan on time and in full. That assurance is your FICO score. Your FICO score is a representation of your creditworthiness. Lending partners use this number, which is between 300 (a poor credit score) and 850 (an excellent credit score), both to predict your ability to pay back a loan and to decide what rates to offer. It is important to note however that a high FICO score is not an automatic guarantee that you will get a loan offer or favorable loan terms and a low FICO score is not an automatic guarantee that you won’t get a loan offer or favorable loan terms.

2. Income and Employment Status

Lending partners will ask about your income and employment status. An income shows whether or not you make enough money to meet monthly payment and a steady job increases the odds that you’ll be able to make payments every month.

3. Debt-to-Income Ratio

Your debt-to-income ratio is the sum of your monthly payments divided by your monthly income. A ratio of around 40% is usually the highest any lending partner will consider. Those with low ratios tend to get lower rates because they’ve shown that they make payments on time and don’t carry a lot of debt.

4. Individual Lenders’ Needs

Lending partners each have different criteria when deciding to extend a loan. Your financial profile and the lending partner’s individual model and specialization can affect the rates that you see. At Seacoast Builders & Design, we will gather rates from several lending partners so you can find a partner who best suits your needs – at the lowest cost.

“Thank you for handling all the permits and paperwork which we know can sometimes be stressful. We appreciate that Seacoast B&D took care of everything. We are very happy with how smoothly the project went. The contractors were very professional and provided quality craftsmanship. Now it is great to enter the renovated rooms, where it feels as if we had a new home.”

“We’re so happy with our decision to choose Seacoast Building & Design to handle our home renovations. From the moment I contacted the office, the entire staff was extremely friendly, knowledgeable, and helpful. The project finished as projected and without problems. They left the property and my home exactly like they found it, probably a bit cleaner if you know the truth.”

“We are very pleased with the Seacoast Building & Design. Your installation crew worked skillfully and had our damage corrected in less than three days. Your sales representative made several very reasonable recommendations for improving our repairs and materials, explained the typical cost and installation time. We are excited to have our home fully restored like new. Thank You!”